- Topic

70k Popularity

44k Popularity

38k Popularity

35k Popularity

76k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win. - 📢 Gate Square Exclusive: #WXTM Creative Contest# Is Now Live!

Celebrate CandyDrop Round 59 featuring MinoTari (WXTM) — compete for a 70,000 WXTM prize pool!

🎯 About MinoTari (WXTM)

Tari is a Rust-based blockchain protocol centered around digital assets.

It empowers creators to build new types of digital experiences and narratives.

With Tari, digitally scarce assets—like collectibles or in-game items—unlock new business opportunities for creators.

🎨 Event Period:

Aug 7, 2025, 09:00 – Aug 12, 2025, 16:00 (UTC)

📌 How to Participate:

Post original content on Gate Square related to WXTM or its

[Forex] Will the hedge fund's selling of yen continue? | Yoshida Tsune's Forex Daily | Manekuri Monex Securities' investment information and media useful for money.

Reason 1 for Selling Yen = Position Adjustment Before Summer Vacation

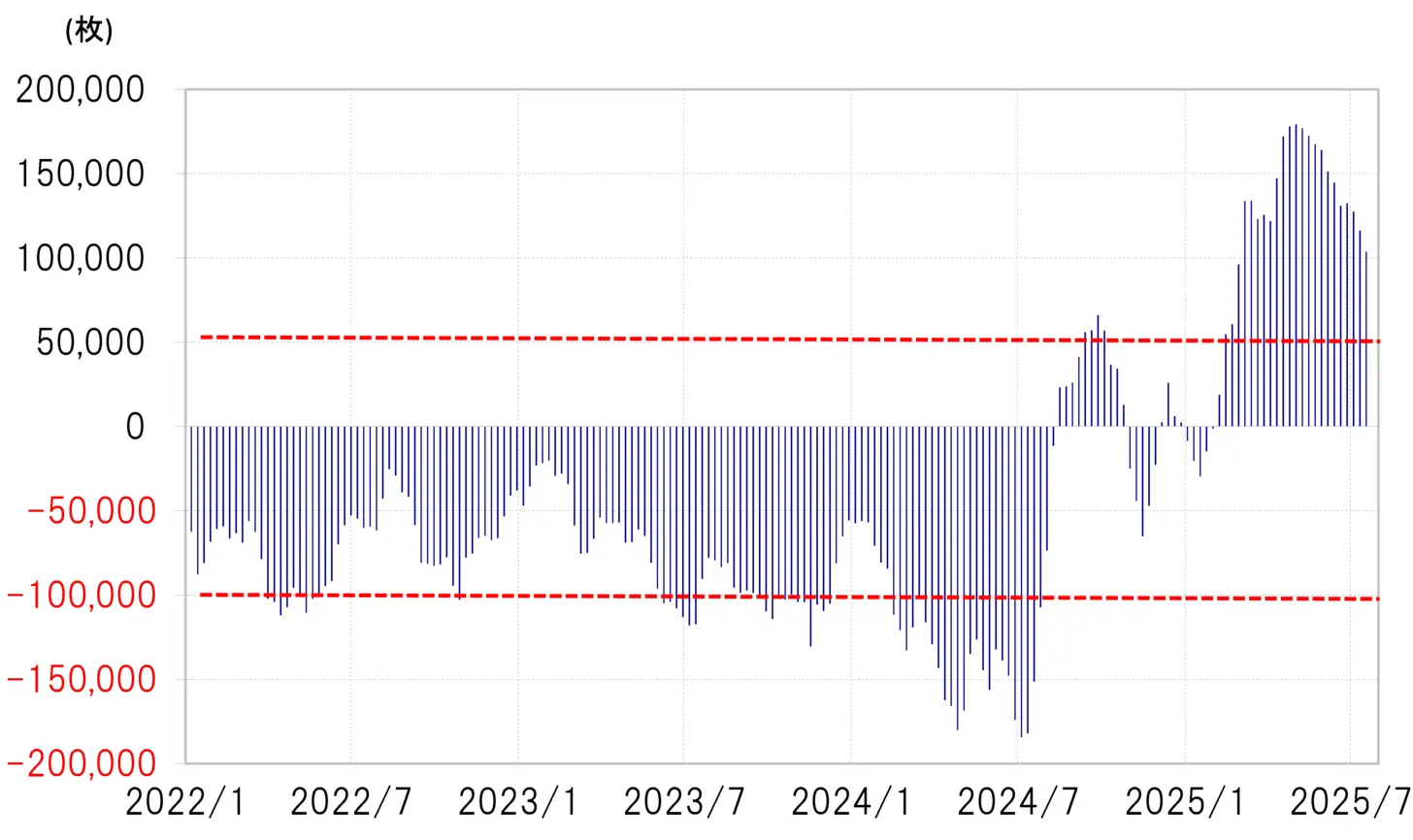

The speculative long positions in yen (short positions in US dollars) reflected in the CFTC (Commodity Futures Trading Commission) statistics for hedge funds have shrunk from 179,000 contracts recorded at the end of April to 100,000 contracts last week (see Chart 1). This reduction in long yen positions is believed to be one of the factors contributing to the temporary rebound of the US dollar to 149 yen last week. So, how long will the yen selling by hedge funds continue?

[Figure 1] CFTC statistics of speculative yen Position (from January 2022) Source: Created by Monex Securities from Refinitiv data

One reason for the reduction of the hedge fund's yen buying Position may be the position adjustment before the summer vacation. The CFTC statistics on yen positions have shown a tendency to move in the opposite direction during August compared to the previous months, which is believed to be influenced by the adjustment of excessive positions before the summer vacation. From this perspective, the yen selling accompanying the closure of yen buying positions may continue into August.

Source: Created by Monex Securities from Refinitiv data

One reason for the reduction of the hedge fund's yen buying Position may be the position adjustment before the summer vacation. The CFTC statistics on yen positions have shown a tendency to move in the opposite direction during August compared to the previous months, which is believed to be influenced by the adjustment of excessive positions before the summer vacation. From this perspective, the yen selling accompanying the closure of yen buying positions may continue into August.

Reason for Yen Selling 2 = Break Even Point for Yen Buying Position

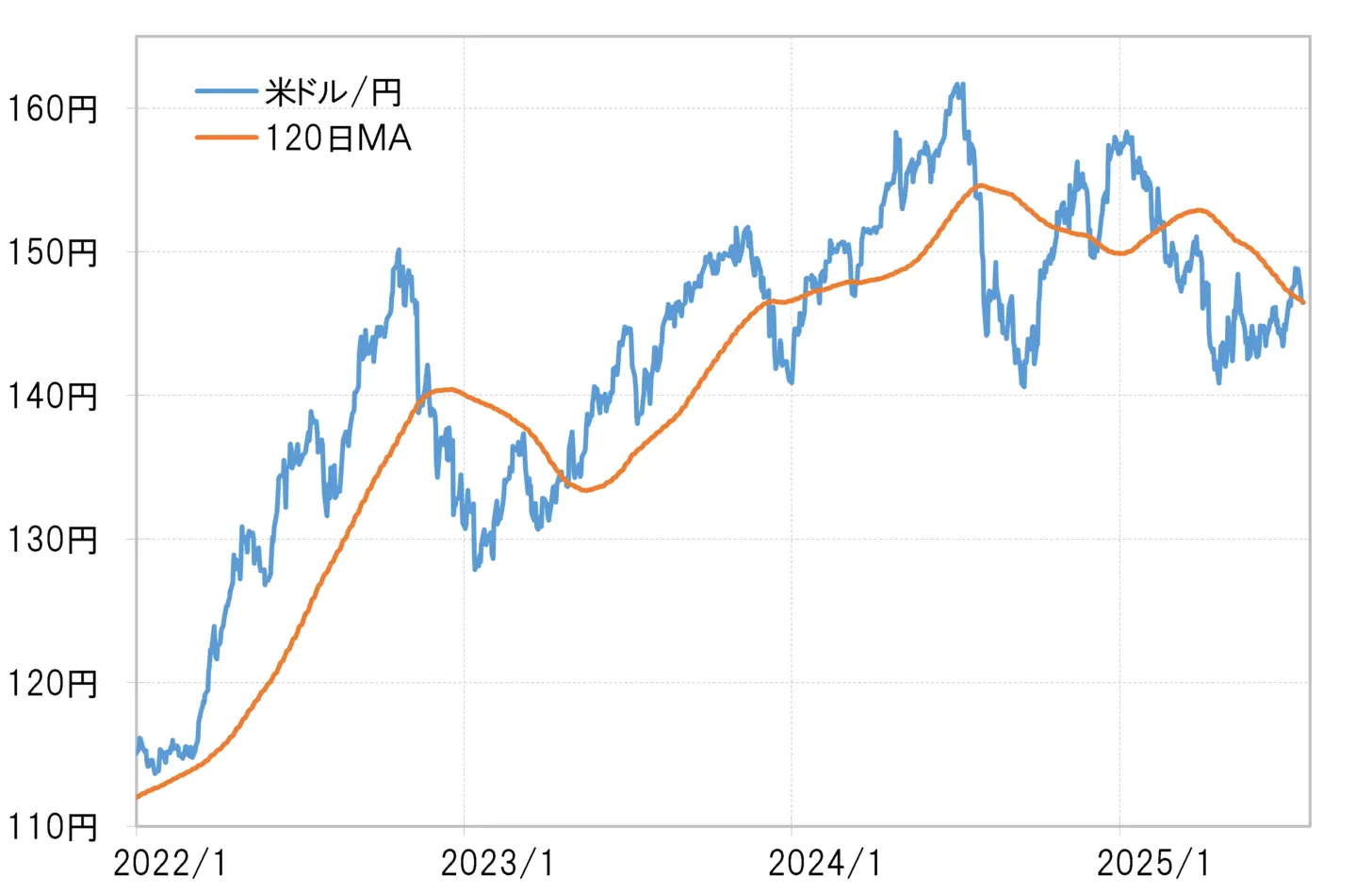

Another point of interest was the break below the breakeven point for yen buying positions. The breakeven point for hedge fund F's yen buying position was estimated to be the 120-day moving average (MA) over the past six months, but from mid-July, the USD/JPY became stronger against the yen (see Chart 2). This means that as yen buying positions fell below the breakeven point and losses began to expand, it is possible that there was an increase in the movement to close positions.

[Figure 2] USD/JPY and 120-day MA (January 2022 - ) Source: Created by Monex Securities from Refinitiv data

However, as of July 24, the 120-day MA for the USD/JPY is around 146.5 yen, and in the past few days, it has returned to that vicinity with a weaker dollar and stronger yen. This means that the expansion of losses on yen-buying positions may have come to a halt. If the losses on yen-buying positions do not further expand from here, it is likely that the yen-selling associated with position liquidation will also subside.

Source: Created by Monex Securities from Refinitiv data

However, as of July 24, the 120-day MA for the USD/JPY is around 146.5 yen, and in the past few days, it has returned to that vicinity with a weaker dollar and stronger yen. This means that the expansion of losses on yen-buying positions may have come to a halt. If the losses on yen-buying positions do not further expand from here, it is likely that the yen-selling associated with position liquidation will also subside.

Hedge Fund Loyal to Trump's Administration's Currency Policy

Another perspective is the impact of U.S. monetary policy. Since the Trump administration began, the trading strategies of hedge funds seem to have become strongly correlated with the monetary policy of the Trump administration. President Trump raised concerns about the significant depreciation of trading partners' currencies that could exacerbate the U.S. trade imbalance, listing currency manipulation as the first of the "eight non-tariff barriers" announced on social media on April 20. In such a context, as the 150 yen mark approaches, hedge funds may also become cautious about further yen depreciation leading to additional yen selling.