Keeta Network: O Próximo Ponto de Explosão no Espaço RWA

O encaminhamento do título original "Alpha Digging" revela a rede pública Keeta Network investida pelo ex-CEO do Google: integrando finanças tradicionais, RWA..

Desde a semana passada, as altcoins geralmente aqueceram, com a maioria dos tokens na cadeia Base se recuperando fortemente de suas mínimas, e o volume de negociações disparando, particularmente com tokens relacionados a IA. A única exceção é a Keeta Network, que se destaca não como um token de IA, mas como uma nova cadeia pública L1. Mesmo antes do lançamento de sua testnet, ganhou atenção devido ao investimento do ex-CEO do Google Eric Schmidt, e o token $KTA mostrou um volume de negociação e crescimento impressionantes.

O token com o maior volume de negociação na rede Base nas últimas 24 horas. Fonte: @Base_Insights

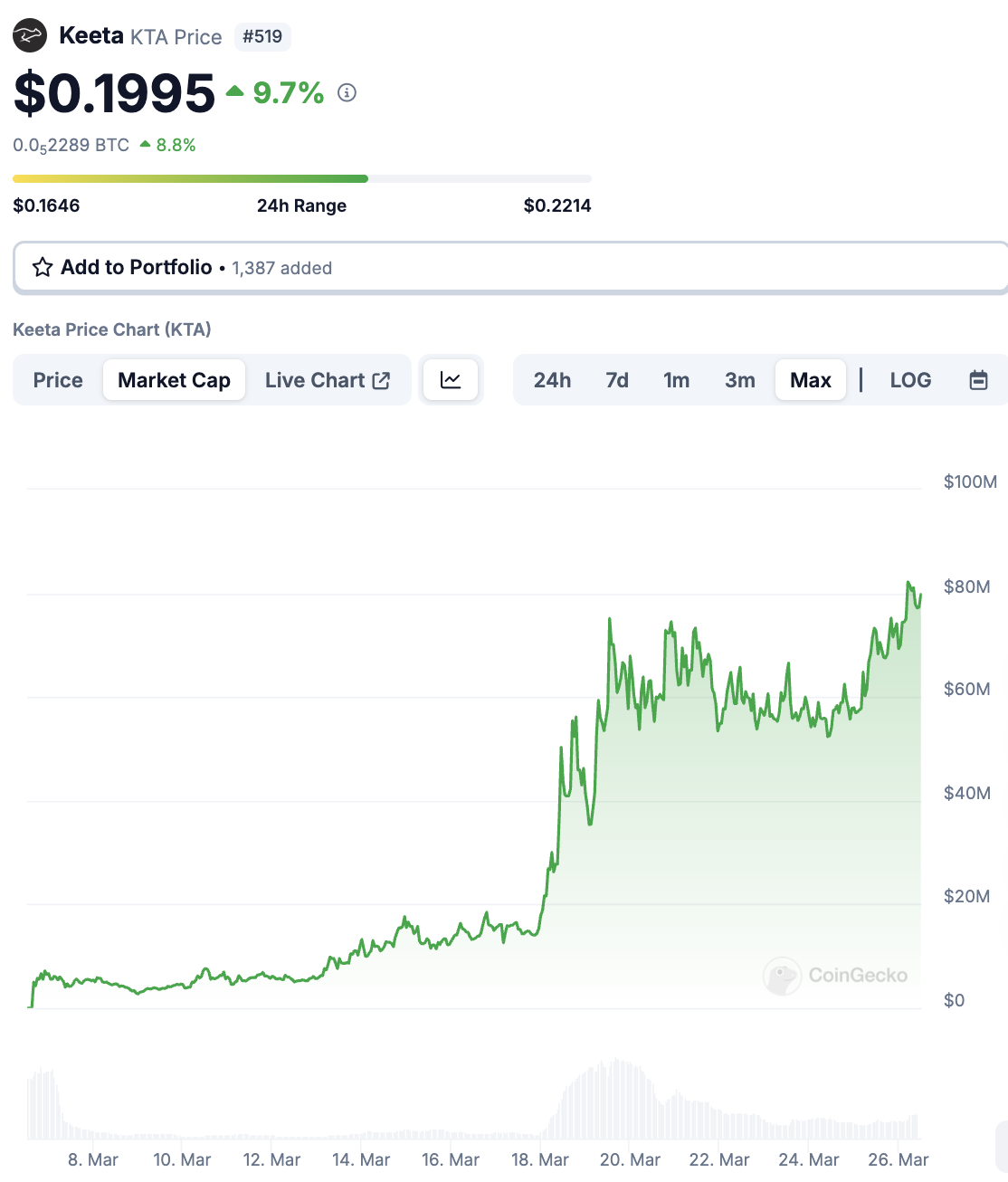

De acordo com os dados do CoinGecko, $KTA tem subido continuamente desde seu lançamento em 6 de março, com um aumento significativo começando no dia 18 e quase nenhuma queda severa. Ontem (25), $KTA atingiu uma alta histórica de $0,2214, com uma capitalização de mercado superior a $88,5 milhões, subindo aproximadamente 10% nas últimas 24 horas e mais de 13 vezes nas últimas duas semanas.

O que há de tão especial neste projeto que faz o mercado buscá-lo com tanta ansiedade? A seguir, você entenderá a arquitetura central e o plano de desenvolvimento da Keeta Network.

Introdução à Keeta Network

Keeta Network é uma blockchain de alto desempenho de Camada-1 dedicada a fornecer soluções seguras, eficientes e altamente interoperáveis para pagamentos globais e transferências de ativos. Sua visão é se tornar o "ponto comum para todas as transferências de ativos", apoiando não apenas transações entre cadeias, mas também enfatizando a integração perfeita com o sistema financeiro tradicional (TradFi).

A intenção original do design da Keeta é abordar os pontos críticos dos sistemas de pagamento tradicionais, como altas taxas de transação, lentidão nas velocidades de liquidação e falta de suporte à conformidade, visando alcançar a liquidação rápida de transações e a tokenização de ativos por meio de sua arquitetura tecnológica.

O fundador e CEO Ty Schenk apontou que o objetivo da Keeta é "tornar as remessas internacionais tão simples e rápidas quanto os pagamentos do Venmo (comparável ao LINE Pay para leitores taiwaneses) sem se preocupar com a segurança dos fundos."

Visão Geral dos Destaques Técnicos

1. Processamento de negociação de alto desempenho

A Keeta afirma ter uma capacidade de processamento de 10 milhões de transações por segundo, com um tempo de liquidação de apenas 400 milissegundos, superando significativamente as cadeias públicas tradicionais e os sistemas de pagamento em termos de eficiência.

Esta performancedeOs seguintes quatro designs:

- 1-1) DAG

Permitir que as transações sejam processadas em paralelo, aumentando assim a capacidade e a escalabilidade.

- 1-2) mecanismo de consenso dPoS

Keeta utiliza o Protocolo de Prova de Participação Delegada (dPoS) como seu mecanismo de consenso, permitindo que os detentores de tokens deleguem seus tokens a representantes que participam da governança e validação de transações, alcançando um processo de validação de blocos rápido e descentralizado através de cinco etapas: iniciar solicitação de votação -> votação temporária -> validação cruzada -> votação final -> transmissão do bloco.

- 1-3) Nós são separados do hardware

Os nós não estão ligados a servidores específicos, permitindo que vários servidores suportem um único nó. Esse design possibilita escalabilidade vertical e horizontal sem interromper o serviço, mantendo velocidades de processamento de transações estáveis mesmo sob alta carga.

- 1-4) Cancelar mecanismo de mempool

Em blockchains tradicionais, o mempool é a área de espera para transações antes de serem adicionadas a um bloco. No entanto, esse design pode levar a atrasos e taxas de transação mais altas durante períodos de alta atividade na rede. A Keeta Network elimina o mempool, permitindo um processamento de transações mais rápido e custos mais baixos.

2. Anchor - Alta Interoperabilidade

Qualquer blockchain pode se conectar à rede Keeta através da função Anchor da Keeta, permitindo que os usuários transfiram ativos entre diferentes blockchains. Ainda mais revolucionário, o Anchor também suporta integração com sistemas de pagamento tradicionais, como SWIFT e ACH, permitindo a troca contínua entre moeda fiduciária e ativos digitais, criando uma rede de interoperabilidade de pagamentos global.

oficialindicar, isso significa que os usuários podem transferir fundos diretamente para contas bancárias externas através do Anchor. Por exemplo, o Bank of America pode transferir dinheiro para bancos dentro da Europa através do SEPA (o sistema de pagamento local da UE) via Anchor, mesmo que a conta do destinatário não esteja dentro da rede Keeta, os fundos ainda podem ser recebidos com sucesso.

3. Conformidade Integrada

O protocolo de conformidade nativo e embutido da Keeta torna viável para instituições altamente reguladas, como bancos centrais e bancos comerciais. Essa interoperabilidade a torna uma plataforma intermediária ideal conectando TradFi e DeFi.

4. Tokenização Nativa

Keeta adota um mecanismo de tokenização nativo que permite a emissão e operação de tokens sem depender de contratos inteligentes, aumentando a eficiência, flexibilidade e reduzindo custos.

Ao contrário de plataformas como o Ethereum, os tokens da Keeta são ativos nativos da rede, permitindo a emissão direta de tokens fungíveis e não fungíveis, e apoiando uma variedade de aplicações, como a representação on-chain de ativos do mundo real (RWA). Ele possui um mecanismo de regras programáveis embutido que permite aos criadores projetar comportamentos e condições específicas, atendendo de forma flexível a diferentes necessidades de tokenização.

5) Identidade Digital

Keeta estabelece um perfil de identidade digital abrangente para cada usuário, integrando certificados emitidos por várias Autoridades Certificadoras (CAs), cobrindo múltiplas verificações do governo, bancos, indústria e academia.

Todas as informações estão vinculadas à chave pública do usuário e podem ser divulgadas seletivamente de acordo com as necessidades. Informações verificadas podem ser compartilhadas para reduzir a verificação redundante, alcançando assim um mecanismo de verificação de identidade entre serviços que é altamente eficiente e focado na privacidade.

6) Sub-rede Privada

Keeta suporta o lançamento de versões privadas na forma de "sub-redes" para atender a necessidades específicas de privacidade em certos cenários. As sub-redes operam da mesma forma que a rede principal, mas as transações não são tornadas públicas na rede principal e podem ser projetadas como centralizadas ou descentralizadas, dependendo dos requisitos. Contas da rede principal podem mudar facilmente para a sub-rede usando uma "chave universal única", e ativos e registros de transações também podem ser sincronizados e atualizados ao voltar para a rede principal.

Em resumo, o potencial da Keeta no setor de pagamentos é visto como um possível desafio aos concorrentes existentes, e foi até referido como um "matador do Ripple" por alguns comentaristas.

Tokenomics

O token nativo da Keeta é $KTA, com um fornecimento total de 1 bilhão de tokens, e a distribuição dos tokens é a seguinte:

- Reserva da Comunidade e Ecossistema (50%): 75% desbloqueado no TGE, a parte restante bloqueada por 6 meses, liberação linear ao longo de 48 meses. Propósito: programa de subsídios, recompensas de staking, promoção do crescimento do ecossistema, provisão de liquidez.

- Equipe (20%): 9 meses de bloqueio, 36 meses de liberação linear

- Investidores iniciais (20%): 6 meses de bloqueio, liberação linear em 24 meses

- Fundação (10%): 3 meses de bloqueio, liberação linear em 48 meses

Equipe e Financiamento

- Fundador: Ty Schenk (@schenkty),Keeta's CEO

- Diretor Técnico: Roy Keene (@yourpal), ex-desenvolvedor chefe da Nano (que já teve um valor de mercado de 4 bilhões de USD).

De acordo com o oficial de 2023DeclaraçãoKeeta garantiu US$ 17 milhões em financiamento de investidores, incluindo o ex-CEO do Google Eric Schmidt e a Steel Perlot Management, alcançando uma avaliação de US$ 75 milhões.

Conclusão: O assassino do Ripple está aqui?

A Keeta Network é altamente procurada pela comunidade devido à sua equipe forte (apoiada pelo ex-CEO do Google e pelo ex-desenvolvedor chefe da Nano) e aos destaques técnicos (10M TPS, suporte a RWA). Seu sistema permissionado e recursos de identidade digital, projetados especificamente para a regulamentação financeira tradicional, resolvem questões de privacidade e conformidade do blockchain. Após o lançamento da mainnet no futuro, os pagamentos internacionais serão o foco principal, e as aplicações subsequentes valem a pena ser aguardadas.

No entanto, a testnet oficial ainda não foi lançada (anunciada para chegar em 23 de março), e seu desempenho real ainda precisa ser verificado. Além disso, os 10 principais detentores de $KTA representam até 67%, o que indica uma alta concentração de chips que deve ser observada. No futuro, é importante monitorar continuamente o progresso da testnet e da mainnet, a taxa de adoção pelos bancos e as mudanças na estrutura dos chips para evitar seguir cegamente as altas.

Declaração:

- Este artigo é reproduzido de [Blocktempo] O título original "Alpha Gold Digging" revela a cadeia pública Keeta Network investida pelo ex-CEO do Google: integrando finanças tradicionais, RWA.., os direitos autorais pertencem ao autor original [DaFi Weaver ], se houver objeções à reimpressão, entre em contato Equipe Gate LearnA equipe irá processá-lo o mais rápido possível de acordo com os procedimentos relevantes.

- Aviso Legal: As opiniões e pontos de vista expressos neste artigo são exclusivamente do autor e não constituem qualquer conselho de investimento.

- As outras versões em idiomas do artigo são traduzidas pela equipe Gate Learn, a menos que mencionado de outra forma.GateNessas circunstâncias, é proibido copiar, disseminar ou plagiar artigos traduzidos.