Say a few more words:

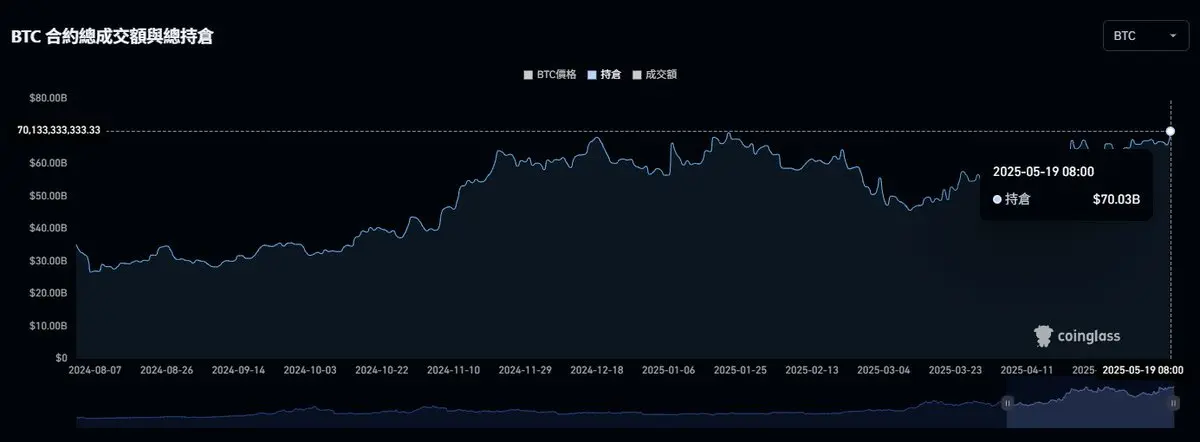

1️⃣ With this amount, it may not be settled within a week, and it will take about 2 to 3 weeks.

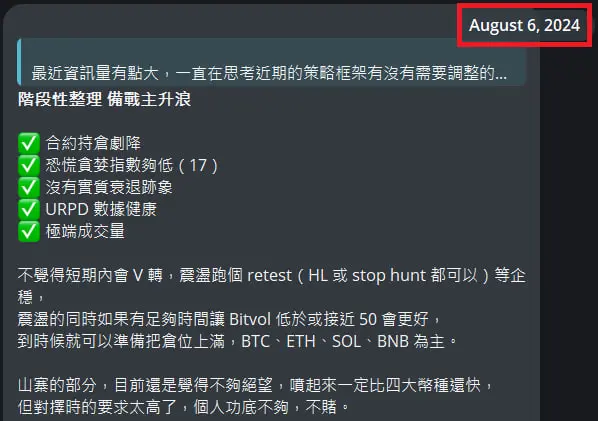

2️⃣ Stage Top: For a detailed review, you can refer to the second link in the text below.

3️⃣ Today the volume of this closing position is very large, but it may not necessarily be a real closing position; in the past, he has also deceived with this.

4️⃣ Wait for it to settle at a very low position + the position starts to move sideways, then it's almost done closing.

5️⃣ After the position closing, I guarantee that I will post a notification for everyone 🫡

View Original1️⃣ With this amount, it may not be settled within a week, and it will take about 2 to 3 weeks.

2️⃣ Stage Top: For a detailed review, you can refer to the second link in the text below.

3️⃣ Today the volume of this closing position is very large, but it may not necessarily be a real closing position; in the past, he has also deceived with this.

4️⃣ Wait for it to settle at a very low position + the position starts to move sideways, then it's almost done closing.

5️⃣ After the position closing, I guarantee that I will post a notification for everyone 🫡